Solar Investment Tax Credit Saves You 30%

There is a generous federal tax credit that lowers the total cost of a renewable energy system by 30%. This solar energy incentive is available for both residential and commercial solar energy installations in Maine. Grid-tied, hybrid, and off-grid photovoltaic solar systems can all qualify.

Tax credits are a dollar-for-dollar reduction in income taxes owed. Thus, they are more valuable for the taxpayer than a write-off. Eligible expenses include the cost of the solar panels, inverter, components, and labor.

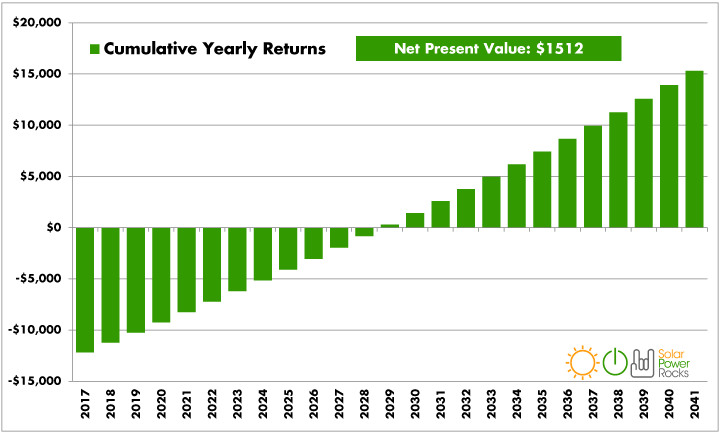

Installing a solar system on your home can qualify you for the Solar Investment Tax Credit. For example, if you install a $10,000 solar system, the tax credit would reduce the installation’s total net cost by an estimated $2,600. Speak with your tax specialist to determine if you’re eligible for this solar energy incentive.

The Solar Investment Tax Credit for residential solar energy has been updated to 30% and as a result, now a great time to invest in a clean energy system for your home!

Get Credited for Surplus Electricity with Net Metering

Solar energy customers connected to the power grid can be credited for the surplus solar electricity they supply. This is called net metering or net energy metering. For example, many solar households generate more solar electricity than they consume on sunny days. If the system doesn’t have batteries, all this electricity goes to the power grid. This results in credits on the electric bill.

Many Sundog Solar customers pay only the monthly connection fee to the electric company. Such homes are net-zero energy. This means that the solar panels generate all the electricity the household consumes throughout the year.