31 Aug How the Federal Solar Tax Credit Works!

Sundog Solar is thrilled to share that US President Joe Biden signed the big climate bill – the Inflation Reduction Act (IRA) – earlier this week. We thought we would help clear up what that means for you, especially the Federal Solar Tax Credit!

How the federal solar tax credit works

Before we get into the solar tax credit specifically, let’s go over the basics of how a tax credit works. If you owe $3,000 in federal taxes but are eligible for a tax credit of $1,000, your tax liability drops to $2,000.

Pretty straightforward.

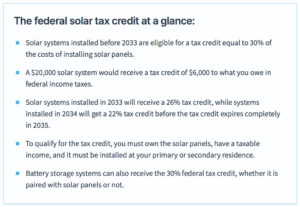

The solar tax credit works just like this. The value of the tax credit you earn is based on a percentage of “qualifying costs” of installing solar panels. For 2022, the solar tax credit is worth 30% of the installation costs. So, if your solar installation cost $20,000, you would be eligible for a non refundable income tax credit of $6,000.

Solar systems installed in 2033 will receive a tax credit equal to 26% of installation costs. In 2034, the tax credit will be worth 22%. In 2035, the federal solar tax credit will expire altogether.

This means a $20,000 solar system installed in 2022 would receive a credit amount of $6,000, while a system installed for the same price in 2033 would only receive $5,200.

How to qualify for the 30% federal solar tax credit

Like we said earlier, most Americans will qualify for the federal tax credit. But, there are some cases where you might not be eligible. The eligibility requirements are as follows:

- The system must be installed between 2022 and 2032.

- You must be the owner of the solar panel system.

- You must have a taxable income.

- The solar system must be installed at your primary or secondary residence.

- It must be claimed on the original installation of the project.

What costs qualify for the federal solar tax credit?

Most, if not all, of the costs associated with installing solar panels are eligible to be covered by the federal solar tax credit. Qualified costs include:

- Equipment: The cost of the solar panels, racking, wiring, and inverters.

- Contractor labor: The cost of labor associated with site preparation, installation, and planning, as well as the cost of any permitting fees and inspections.

- Sales tax: Any sales tax associated with the above costs is also covered by the tax credit.

Are battery storage systems eligible for the federal solar tax credit?

Yes, energy storage is covered by the 30% tax credit. Thanks to the passage of the Inflation Reduction Act, standalone battery systems that charge from the utility grid can now take advantage of the tax credit, along with batteries that are paired with solar panels. On average, residential batteries cost between $15,000 and $20,000 to install, so you can expect to receive a tax credit between $4,500 and $6,000 for energy storage.” If the battery is installed with solar panels, the battery costs will be bundled with the rest of your solar installation costs. If a standalone battery is installed without solar, you will get a tax credit based on the cost of the battery installation. The battery must be installed in the home of the taxpayer, and it must be at least 3 kilowatt-hours (kWh) in size. Our recommended battery is the Tesla Powerwall, which offers 13.5 kWh of usable storage, so you likely won’t have to worry about the minimum capacity requirement.

When and for how long can I claim the solar tax credit?

If you’re eligible for the ITC, but you don’t owe any taxes during the given calendar year, the IRS will not refund you with a check for claiming the credit. The 30 percent ITC is not refundable. However, the ITC can be carried forward as long as it remains in effect (i.e., through 2034 for residential systems as it stands today). Therefore, if you have a tax liability next year, but don’t have any this year, you can still claim the credit.

Stay tuned for more information on more electrification incentives included in the IRA! There really has never been a better time to invest in renewable energy.

Contact us now to get a free estimate! With the new tax credit lead times are going to grow, so let’s get you in the queue before winter.